Cryptocurrency Tax

Experts Central Coast

- Our Central Coast accountants are experts in the tax implications of Crypto.

- We can advise and help you report all CGT and right-offs for losses on Crypto.

- The team are available for in-person meetings and can always take a call.

- We can support or represent you in the case of an ATO audit.

Contact us today to arrange an initial consultation with no obligations.

What is Cryptocurrency?

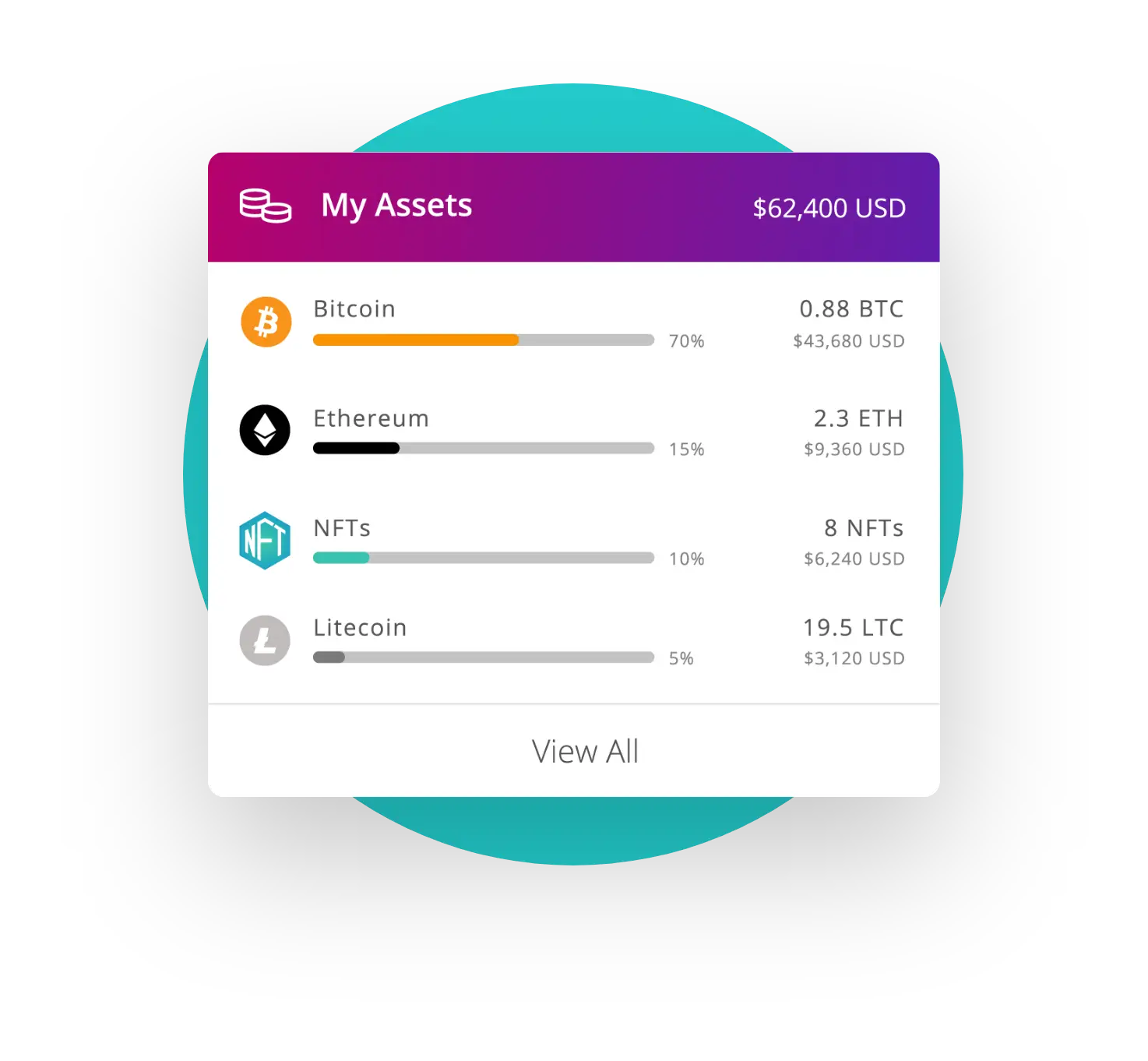

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. Popular examples include Bitcoin, Ethereum, and Litecoin. Cryptocurrencies can be used for various purposes, including investment, trading, and purchasing goods and services.

Holders, staking, NFT’s traders, dumpers, bot operators – this is the page for you

Get In Touch

Our new clients are offered an initial consultation to explain their business and individual goals. During this initial meeting, we also take this opportunity to understand your requirements and how we can help you by looking into any obstacles that may prevent you from moving forward.

We are Crypto tax experts

in Gosford

Crypto tax must be reported when you lodge your annual tax return. You need to declare any capital gains or losses from the disposal of cryptocurrency. This includes trading, selling, gifting, exchanging one crypto asset for another, converting crypto to fiat currency, or using crypto to obtain goods or services.

Investors must keep detailed records of each transaction, including dates, the value in Australian dollars at the time of the transaction, the nature of the transaction, and the parties involved. These records will help in accurately calculating and reporting CGT.

What are the tax implications of Cryptocurrency for investors?

The main thing to keep in mind is that cryptocurrency transactions are subject to tax obligations in Australia. The Australian Taxation Office (ATO) treats cryptocurrencies as assets for capital gains tax (CGT) purposes. This means that any disposal of cryptocurrency, such as trading, selling, or exchanging it for another crypto asset or fiat currency, must be reported and may result in a capital gain or loss. If you hold the cryptocurrency for more than 12 months, you may be eligible for a 50% CGT discount on the capital gain. Additionally, any income received from staking rewards or airdrops must be reported as other income. In summary, accurate record-keeping is crucial to ensure all transactions are correctly reported and to avoid potential penalties from the ATO.

We won’t make this complex for you, but we will need some of the records below to be able to assist you.

- CSV/Spreadsheets of your exchanges and wallets revealing all your trades.

- A record of each Cryptocurrency you currently own as of 30th June.

- Records of any costs, just as hardware wallets, monthly fees or mining/staking costs.

- Some traders have online cryptocurrency booking accounts such as Coin Training.

- So , we will need to see a file or have access.

- Document reports of all transactions for trade shares are bound to received form brokers

- These financial reports classify the ownership of shares, you own as of 30th June.

- Any tax-deductible expenditure, we can discuss this in more details.

Frequently Asked Crypto Tax Questions

What happens if I don't report my cryptocurrency transactions?

The ATO uses data matching from banks, financial institutions, and crypto exchanges to track transactions. Failure to report can result in penalties and audits.

How are staking rewards and airdrops taxed?

Staking rewards and airdrops are considered income and must be included in your tax return as other income.

Can I claim a capital loss if the value of my cryptocurrency decreases?

You can only claim a capital loss when you dispose of the cryptocurrency. Paper losses, where the value decreases but the asset is not sold, cannot be claimed.

Do I need to pay tax if I hold my cryptocurrency for more than 12 months?

Yes, but you may be eligible for a 50% CGT discount if you hold the cryptocurrency for at least 12 months before disposing of it.